A significant story in excess of the past two many years has been the rise in dwelling prices. There are a lot of variables at enjoy. Tight source is one. An influx of people transferring to a lot more attractive places is an additional. But soaring interest fees are threatening to stymie the housing marketplace. There are even fears that some of the latest gains could be reversed.

That has pushed house improvement shops Household Depot (Hd 2.38%) and Lowe’s (Very low 2.09%) very well beneath the highs they reached at the close of final 12 months. But individuals fears could be providing investors an prospect. Is a single of them superior than the other? Wall Street thinks so. And these charts exhibit why.

Impression resource: Getty Visuals.

One particular is generally much more high-priced than the other

For the past decade, Wall Avenue has been inclined to shell out a greater valuation for Home Depot than for Lowe’s. As the valuation of the total inventory industry oscillated, the two home improvement merchants did a dance of incredible predictability. Resembling poles of two magnets repelling each other, the price-to-income ratios kept their distance.

High definition PS Ratio details by YCharts

It truly is also constantly extra profitable

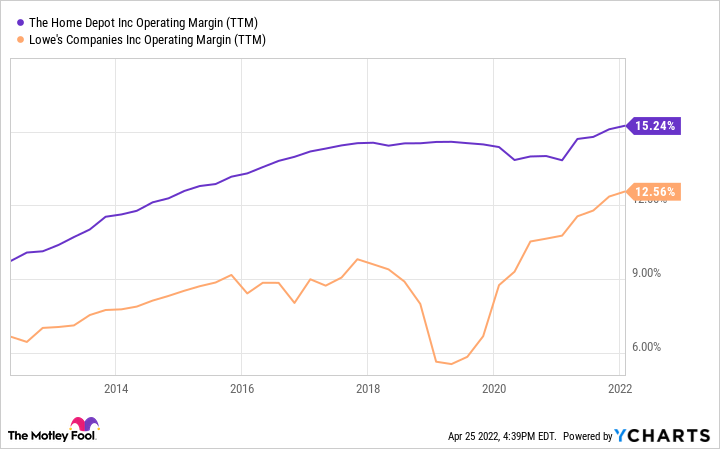

A person good rationalization is Household Depot’s profitability. More than that 10 years, its running margin stayed at the very least just one-fifth better than that of Lowe’s. The company a short while ago warned that income margins would suffer as expenses surge.

Management went so significantly as to charter its possess cargo ship to prevent the snarled global offer chain. Historically, Lowe’s has expended additional on bills like product sales, marketing and advertising, and administrative capabilities this sort of as human means and accounting. In 2021, the difference was about a small far more than 2% of profits — about the hole in functioning margin.

Hd Functioning Margin (TTM) details by YCharts

In sharp distinction to historical past, the recent update at Lowe’s was optimistic. In February it lifted its complete-yr estimates for income and gains.

And it can be in a better placement to take care of its personal debt

One particular location in which Lowe’s appears extra interesting is the amount of money of debt it carries when compared to Residence Depot. It has $30 billion in combined short- and extensive-phrase financial debt on its harmony sheet. Property Depot has $45 billion.

But digging a minor further reveals that House Depot is in a more robust money placement, since it generates almost twice the earnings ahead of fascination and taxes (EBIT). That suggests its periods curiosity earned ratio — the amount of situations the EBIT can cover annual interest payments — is much higher.

Reduced Instances Curiosity Earned (TTM) knowledge by YCharts

It has grown speedier, as well

All of this neglects the 1 metric quite a few buyers prioritize in excess of all other folks: advancement. Listed here as well, Household Depot wins. Neither company is in hypergrowth method, and both of those benefited a whole lot in the course of the pandemic from consumers’ willingness to shell out on housing. But above the past five- and 10-12 months periods, the leading line at Loew’s has expanded at a slower pace.

Hd Earnings (TTM) details by YCharts

Which just one pays you additional to possess shares?

Investors could count on Lowe’s to make up for these perceived shortfalls by spending a higher dividend to shareholders. They would be wrong. Dwelling Depot’s distribution significantly exceeds that of Lowe’s. It has for most of the earlier decade.

High definition Dividend Produce data by YCharts

That isn’t going to account for all of the strategies to return funds to shareholders. Lowe’s has done noticeably extra inventory buybacks in the previous couple many years. In simple fact, it has repurchased 17% of shares outstanding in just the earlier three several years. Dwelling Depot has purchased again just 6%.

Lowe’s also has extra room to increase the dividend in the upcoming. It sends fewer than a single-quarter of earnings back again to shareholders as dividends. For Residence Depot, the quantity is about four-fifths. Nonetheless, each can conveniently do it for the foreseeable future.

Is the changing of the guard close to?

If you’re hunting to insert one of the massive-box residence enhancement suppliers to your portfolio, the historical metrics make a compelling situation for Home Depot about Lowe’s. But that could be shifting. Differing 2022 outlooks and an intense buyback method have Lowe’s wanting and sounding like the outdated Dwelling Depot that Wall Avenue fell in like with.

Both of those offer buyers publicity to an sector at the coronary heart of the American overall economy. With potent cash return systems, strong margins, and workable personal debt, there is no erroneous alternative. But Home Depot has proved it can execute around time. That is why I would lean toward it if pressured to decide on. Of system, there’s no rule against buying both.