Some say volatility, fairly than credit card debt, is the finest way to think about threat as an trader, but Warren Buffett famously stated that ‘Volatility is far from synonymous with hazard.’ When we think about how dangerous a firm is, we usually like to appear at its use of financial debt, since debt overload can lead to damage. Importantly, Somany Household Innovation Constrained (NSE:SHIL) does carry credit card debt. But the much more significant question is: how much danger is that financial debt creating?

What Danger Does Credit card debt Provide?

Credit card debt is a software to assist firms improve, but if a business is incapable of paying off its lenders, then it exists at their mercy. If matters get really bad, the loan providers can take management of the business. Nonetheless, a additional common (but however highly-priced) condition is wherever a organization need to dilute shareholders at a low-cost share value basically to get debt below command. Of course, the upside of credit card debt is that it typically signifies low-priced funds, primarily when it replaces dilution in a company with the skill to reinvest at higher costs of return. The initially detail to do when contemplating how substantially debt a business enterprise employs is to glimpse at its money and personal debt collectively.

Look at our newest evaluation for Somany Household Innovation

How Considerably Credit card debt Does Somany Residence Innovation Carry?

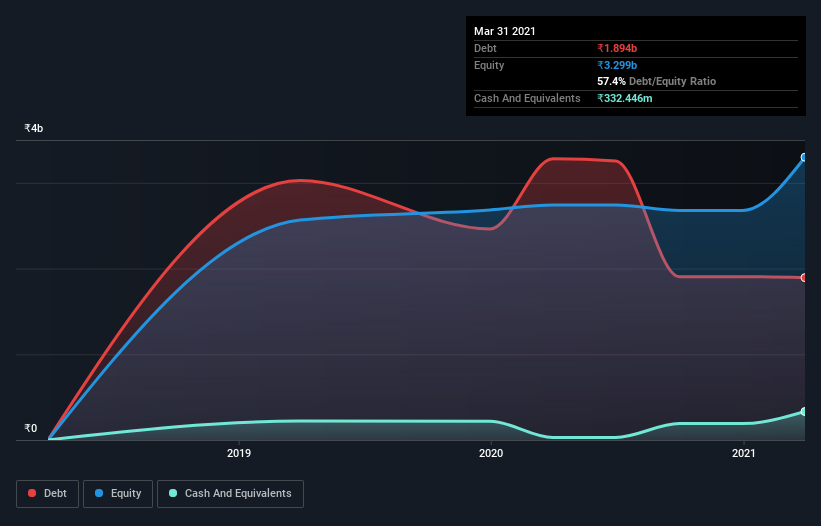

The graphic below, which you can simply click on for higher element, demonstrates that Somany Property Innovation experienced personal debt of ₹1.89b at the conclude of March 2021, a reduction from ₹3.26b more than a year. Nevertheless, for the reason that it has a funds reserve of ₹332.4m, its web financial debt is a lot less, at about ₹1.56b.

How Solid Is Somany Dwelling Innovation’s Equilibrium Sheet?

The latest stability sheet information exhibits that Somany Dwelling Innovation experienced liabilities of ₹5.80b because of in a year, and liabilities of ₹1.28b slipping owing immediately after that. Offsetting this, it experienced ₹332.4m in money and ₹4.08b in receivables that were thanks in just 12 months. So it has liabilities totalling ₹2.67b a lot more than its funds and around-term receivables, combined.

Because publicly traded Somany Residence Innovation shares are really worth a whole of ₹30.9b, it seems not likely that this degree of liabilities would be a major danger. Nevertheless, we do assume it is worth retaining an eye on its balance sheet energy, as it might adjust in excess of time.

We evaluate a company’s financial debt load relative to its earnings electricity by wanting at its web credit card debt divided by its earnings just before fascination, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings in advance of interest and tax (EBIT) include its fascination expenditure (fascination go over). Therefore we think about financial debt relative to earnings equally with and without depreciation and amortization expenditures.

On the lookout at its internet credit card debt to EBITDA of .79 and desire cover of 6.6 instances, it appears to us that Somany House Innovation is probably utilizing credit card debt in a very sensible way. So we might advise keeping a close eye on the affect funding costs are acquiring on the business enterprise. Even far more extraordinary was the reality that Somany House Innovation grew its EBIT by 507% in excess of twelve months. That boost will make it even simpler to pay back down financial debt heading ahead. There is certainly no question that we find out most about debt from the balance sheet. But you can’t look at debt in total isolation since Somany Household Innovation will want earnings to company that financial debt. So when thinking of personal debt, it is surely worthy of hunting at the earnings trend. Click on below for an interactive snapshot.

But our last thing to consider is also important, for the reason that a corporation are not able to fork out financial debt with paper revenue it requires cold challenging money. So the reasonable step is to glance at the proportion of that EBIT that is matched by true no cost hard cash stream. Over the past 3 several years, Somany Property Innovation recorded cost-free hard cash stream worthy of a fulsome 94% of its EBIT, which is much better than we’d usually expect. That positions it effectively to fork out down debt if desirable to do so.

Our Perspective

The fantastic information is that Somany House Innovation’s shown means to convert EBIT to no cost income movement delights us like a fluffy dog does a toddler. And the excellent information does not quit there, as its EBIT growth rate also supports that impact! Thinking of this variety of components, it appears to us that Somany Property Innovation is rather prudent with its debt, and the threats seem to be properly managed. So we’re not concerned about the use of a very little leverage on the stability sheet. When analysing financial debt ranges, the harmony sheet is the noticeable area to commence. On the other hand, not all expense threat resides inside the harmony sheet – considerably from it. To that conclusion, you really should be mindful of the 3 warning symptoms we have noticed with Somany Household Innovation .

If, following all that, you might be much more intrigued in a rapidly expanding corporation with a rock-strong harmony sheet, then check out our list of net money progress stocks with out delay.

If you’re hunting to trade Somany Property Innovation, open up an account with the least expensive-value* platform reliable by specialists, Interactive Brokers. Their clientele from above 200 nations around the world and territories trade shares, alternatives, futures, foreign exchange, bonds and resources throughout the world from a one integrated account. Promoted

This report by Just Wall St is basic in mother nature. We deliver commentary based on historical details and analyst forecasts only working with an impartial methodology and our content articles are not meant to be economic advice. It does not constitute a recommendation to acquire or offer any stock, and does not acquire account of your goals, or your fiscal predicament. We intention to bring you long-expression targeted examination pushed by fundamental facts. Notice that our investigation might not aspect in the newest value-delicate firm announcements or qualitative product. Simply Wall St has no posture in any shares stated.

*Interactive Brokers Rated Most affordable Charge Broker by StockBrokers.com Annual On line Overview 2020

Have opinions on this short article? Anxious about the written content? Get in contact with us specifically. Alternatively, e-mail editorial-team (at) simplywallst.com.