It really is only all-natural that numerous traders, in particular people who are new to the recreation, choose to invest in shares in ‘sexy’ shares with a fantastic tale, even if people corporations drop cash. And in their analyze titled Who Falls Prey to the Wolf of Wall Road?’ Leuz et. al. observed that it is ‘quite common’ for traders to drop cash by purchasing into ‘pump and dump’ techniques.

If, on the other hand, you like businesses that have profits, and even get paid earnings, then you could nicely be intrigued in Somany Residence Innovation (NSE:SHIL). Now, I am not declaring that the inventory is automatically undervalued currently but I won’t be able to shake an appreciation for the profitability of the organization by itself. Loss-creating businesses are usually racing versus time to attain economical sustainability, but time is typically a friend of the profitable company, particularly if it is escalating.

Check out our most up-to-date investigation for Somany Residence Innovation

How Quick Is Somany Household Innovation Growing?

If a enterprise can preserve growing earnings per share (EPS) extensive adequate, its share value will sooner or later adhere to. That would make EPS expansion an eye-catching high quality for any company. As a tree reaches steadily for the sky, Somany Household Innovation’s EPS has grown 27% each and every yr, compound, around 3 a long time. As a general rule, we’d say that if a company can continue to keep up that type of progress, shareholders will be smiling.

A single way to double-examine a firm’s advancement is to glance at how its profits, and earnings ahead of fascination and tax (EBIT) margins are modifying. Somany Dwelling Innovation shareholders can choose self confidence from the fact that EBIT margins are up from 4.2% to 6.8%, and revenue is rising. That’s good to see, on equally counts.

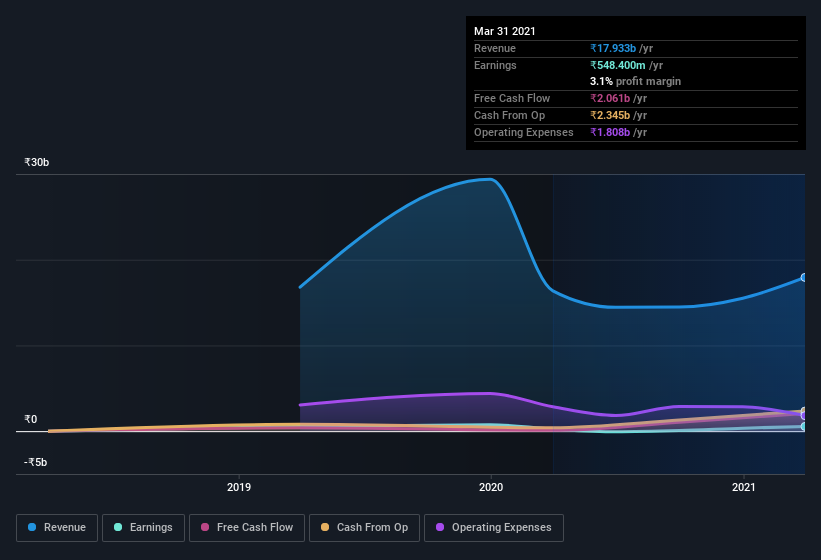

You can consider a appear at the firm’s income and earnings progress development, in the chart underneath. To see the actual figures, simply click on the chart.

When it truly is generally good to see expanding earnings, you really should normally keep in mind that a weak stability sheet could come back to chunk. So check Somany Dwelling Innovation’s balance sheet strength, just before acquiring way too excited.

Are Somany House Innovation Insiders Aligned With All Shareholders?

It will make me experience much more secure proudly owning shares in a company if insiders also personal shares, thusly much more closely aligning our interests. As a result, I am inspired by the point that insiders own Somany Household Innovation shares value a considerable sum. With a whopping ₹4.6b worth of shares as a team, insiders have plenty using on the company’s results. That holding quantities to 18% of the stock on difficulty, hence earning insiders influential, and aligned, proprietors of the company.

It is excellent to see that insiders are invested in the organization, but are remuneration amounts reasonable? Very well, centered on the CEO pay, I would say they are indeed. I identified that the median overall compensation for the CEOs of organizations like Somany Dwelling Innovation with current market caps among ₹15b and ₹60b is about ₹22m.

The CEO of Somany Household Innovation only acquired ₹8.4m in whole compensation for the calendar year ending . Which is obviously properly underneath regular, so at a look, that arrangement would seem generous to shareholders, and factors to a modest remuneration lifestyle. CEO remuneration ranges are not the most crucial metric for investors, but when the pay back is modest, that does assistance improved alignment involving the CEO and the everyday shareholders. It can also be a signal of superior governance, extra usually.

Does Somany Property Innovation Deserve A Place On Your Watchlist?

For growth investors like me, Somany Home Innovation’s uncooked rate of earnings growth is a beacon in the evening. If you require much more convincing outside of that EPS expansion rate, never ignore about the sensible remuneration and the superior insider ownership. Each to their personal, but I consider all this would make Somany Home Innovation appear alternatively attention-grabbing indeed. You really should always think about dangers however. Scenario in point, we’ve noticed 1 warning indicator for Somany Dwelling Innovation you really should be informed of.

Whilst Somany Property Innovation certainly appears to be superior to me, I would like it much more if insiders were being obtaining up shares. If you like to see insider obtaining, far too, then this totally free record of escalating businesses that insiders are obtaining, could be specifically what you happen to be seeking for.

Please take note the insider transactions mentioned in this article refer to reportable transactions in the suitable jurisdiction.

Promoted

When buying and selling Somany Property Innovation or any other financial commitment, use the platform viewed as by numerous to be the Professional’s Gateway to the Worlds Market place, Interactive Brokers. You get the most affordable-cost* buying and selling on shares, alternatives, futures, forex, bonds and money around the world from a one integrated account.

This article by Only Wall St is typical in nature. It does not represent a advice to purchase or market any stock, and does not take account of your goals, or your fiscal predicament. We goal to deliver you extended-time period targeted assessment driven by basic knowledge. Observe that our assessment may well not factor in the hottest cost-delicate corporation bulletins or qualitative materials. Only Wall St has no placement in any shares pointed out.

*Interactive Brokers Rated Most affordable Value Broker by StockBrokers.com Yearly On line Evaluation 2020

Have suggestions on this posting? Concerned about the content material? Get in touch with us straight. Alternatively, electronic mail editorial-staff (at) simplywallst.com.